Friday, January 29, 2010

Major Taiwan-based memory module houses are expected to see their revenues stay flat sequentially in January 2010, but revenues for all of the first quarter may decrease slightly on quarter mainly due to fewer working days in February, according to industry sources.

Inventory replenishments ahead of the upcoming Lunar New Year holidays have not been as strong as expected, lowering DRAM spot prices, the sources said.

But the sources said the recent drops in DDR3 spot pricing were triggered by a downward price correction for DDR2. Supply of DDR3 chips is still limited, which suggests its pricing has little room for further fall, the sources commented.

In contrast to DRAM, NAND flash prices are becoming stable enough to help some module houses offset their lost sales from the DRAM segment in January. These makers' January revenues are expected to stay level or even grow slightly on month, according to the sources.

A-Data Technology, whose sales from NAND flash devices began outpacing those from DRAM modules in 2009, may see January revenues remain similar to last month's levels, the sources said. Rival Transcend Information, which focuses more on NAND flash products, is likely to have flat to slight revenue growth sequentially in January.

Memory controller-IC specialist Phison Electronics, which also makes NAND flash devices, is likely to see a strong growth in January, according to the sources.

Phison has estimated January revenues at more than NT$2.6 billion (US$81 million), compared to NT$2.3 billion in December 2009.

In other news, spot prices for 1Gb DDR3 recently slid to below US$3, and continued to edge down to average US$2.89 on January 27, according to DRAMeXchange. Meanwhile, average prices for branded and effectively tested (eTT) 1Gb DDR2 dropped 0.9% and 1.3% in one day to close at US$2.32 and US$2.15, respectively, yesterday.

|

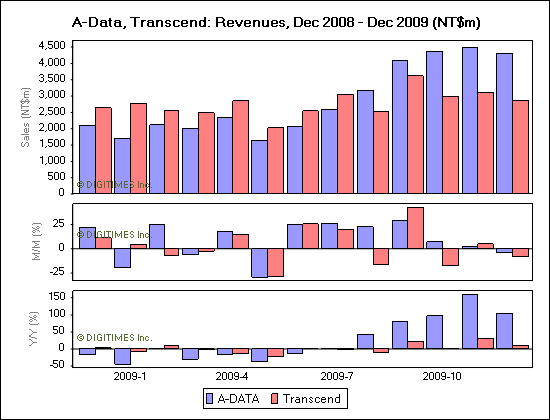

A-Data, Transcend: Revenues, Dec 2008 - Dec 2009 (NT$m) |

|

Month |

Transcend |

A-DATA |

|

Sales |

Y/Y |

Sales |

Y/Y |

|

Dec-09 |

2,873 |

8.9% |

4,294 |

104.5% |

|

Nov-09 |

3,121 |

31.4% |

4,479 |

160.2% |

|

Oct-09 |

2,974 |

0.3% |

4,365 |

96.8% |

|

Sep-09 |

3,615 |

21.4% |

4,085 |

79.1% |

|

Aug-09 |

2,538 |

(10.4%) |

3,176 |

42.5% |

|

Jul-09 |

3,046 |

(3.5%) |

2,588 |

1.1% |

|

Jun-09 |

2,546 |

0.3% |

2,054 |

(13.5%) |

|

May-09 |

2,028 |

(22.6%) |

1,650 |

(37.1%) |

|

Apr-09 |

2,858 |

(12.6%) |

2,341 |

(17.5%) |

|

Mar-09 |

2,490 |

(2.8%) |

1,990 |

(30.9%) |

|

Feb-09 |

2,555 |

9.3% |

2,125 |

1% |

|

Jan-09 |

2,760 |

(8.8%) |

1,697 |

(45%) |

|

Dec-08 |

2,639 |

3% |

2,100 |

(17.8%) |

*Figures are not consolidated

Source: TSE, compiled by Digitimes, January 2010

By: DocMemory

Copyright © 2023 CST, Inc. All Rights Reserved

|